When you are young and planning your finances, you don’t often think about the prospect of needing to be cared for in the future. However, eventually, we all reach the point in life where we realize how essential preparation is. When everything is taken into consideration, there are basically three options to choose from in preparation for the twilight years:

- Do nothing (have enough assets to self-insure)

- Buy nursing home insurance (consider that premiums will increase in the future)

- Develop a Medicaid spend-down plan(recommended)

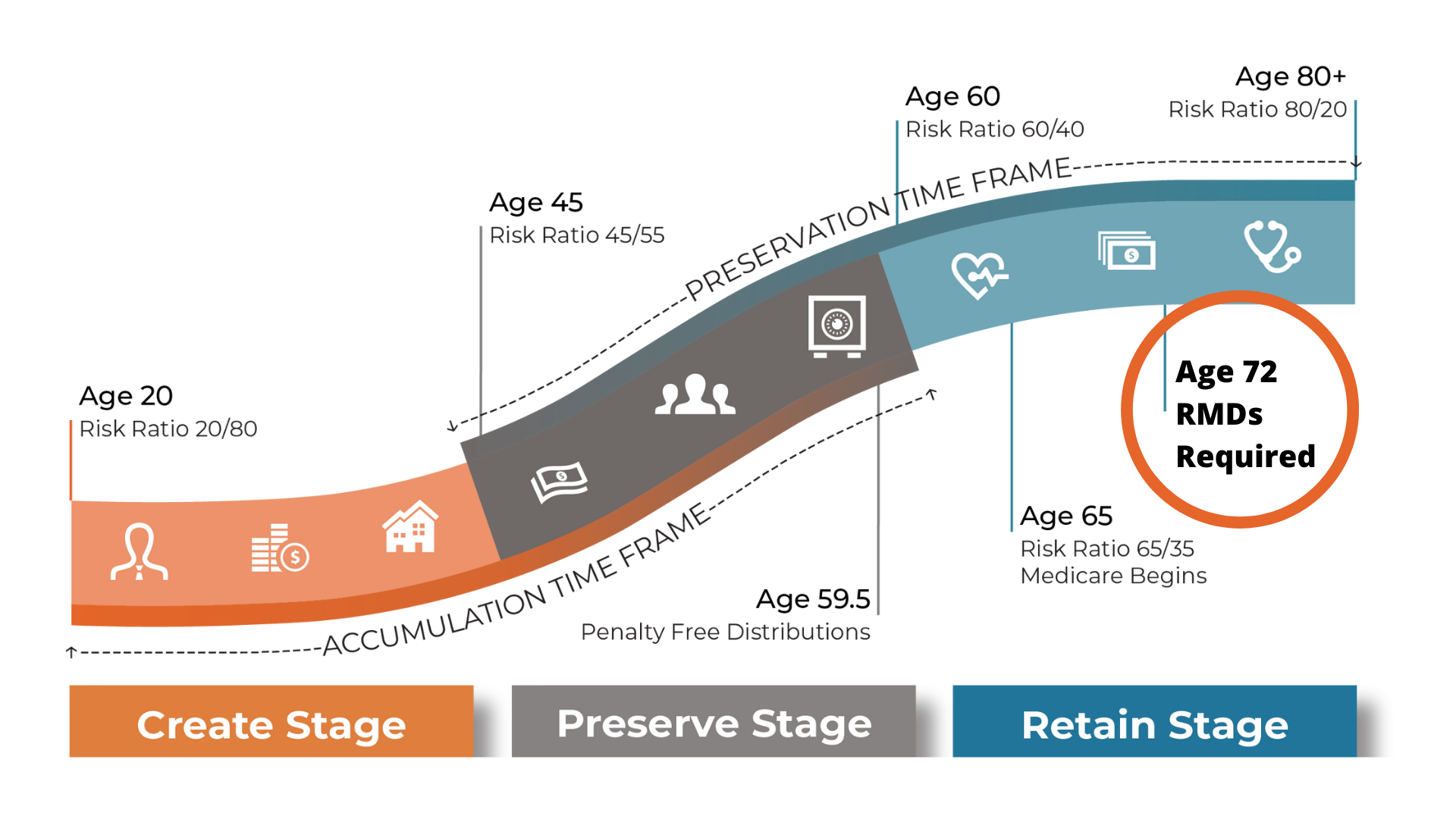

Assisted living costs can be unreasonably high. The prospect of affording this cost while living on a fixed income (for example, Social Security) and having no help with healthcare costs can be troubling. Moreover, at this point in life, one wants to minimize expenses as much as possible. This is precisely why, at Wealth Management Accounting (WMA), Medicaid spend-down is an essential part of our Financial Circle of Care (FCOC) and our Create, Preserve, Retain (CPR) planning process (pictured below).

Medicaid spend-down is the process of spending down assets and income to be eligible for Medicaid. In cooperation with a family LLC (FLLC), you can maintain control of your assets after this spend-down. In turn, this will allow more of your assets to cover other necessities and potential emergencies. It is important to note that WMA considers an FLLC mandatory for the Medicaid spend-down process. Using alternative methods can make it challenging to achieve the spend-down without losing control of assets.

Benefits of the Family LLC Regarding Medicaid Spend-Down

To be eligible for Medicaid, the value of an applicant’s total income and assets must be less than a specific amount. The nature of the spend-down is to achieve eligibility for Medicaid while still controlling assets. One of the significant benefits of having Medicaid is that it can help cover long-term care costs. Additionally, Medicaid can also help cover medical bills and pharmaceutical costs. Using an FLLC means that medical expenses can be covered by Medicaid while retaining the assets. In essence:

- The client’s assets are protected

- The client has complete control

- The client has more privacy

Another consideration of our planning process is the 5-year Medicaid lookback. This is when Medicaid looks at previous asset transfers and identifies anything sold or gifted under the fair market value during those five years. If the value of these transactions exceeds the threshold for Medicaid, there is a penalty. This penalty is because the value of these assets could have been used for medical care. The date of one’s application to Medicaid is also the beginning of their lookback period. Therefore, if one applied for Medicaid on January 1, 2022, their lookback would span until December 31, 2016. Taking this into consideration, we begin securing assets long before the Medicaid lookback.

WMA Planning

WMA understands that everyone’s financial fingerprint is different; each client will require a unique plan to help them accomplish their goals. Therefore, our planning includes the following:

- Determining asset limits and identifying assets that need to be spent down

- Establishing how much income needs to be spent down and how to do this to the client’s benefit

- Consideration of the 5-year lookback

Medicaid spend-down is only one component of WMA’s Financial Circle of Care. Along with the IRA rescue plan, a coordinated FLLC, and survivor assistance, we cover all financial aspects of retirement. Designed with foresight based on hundreds of cases, we tackle problems before they arise.