Ironically, the number one problem in estate planning is too much qualified money. Most assume that IRAs are a helpful tool for retirement, and they are. Like everything in life, they have their place, but they should not be the end-all solution for retirement. Many clients have a higher (more significant) amount of qualified than non-qualified funds. Without a plan to reduce your IRA or 401k funds, you could get stuck paying higher taxes due to your tax bracket for the rest of your life. Being trapped in this higher bracket means potentially unnecessarily losing hard-earned savings to taxes. This dilemma is known as the “IRA time bomb.” IRA Rescue is the process of defusing the “IRA time bomb.”

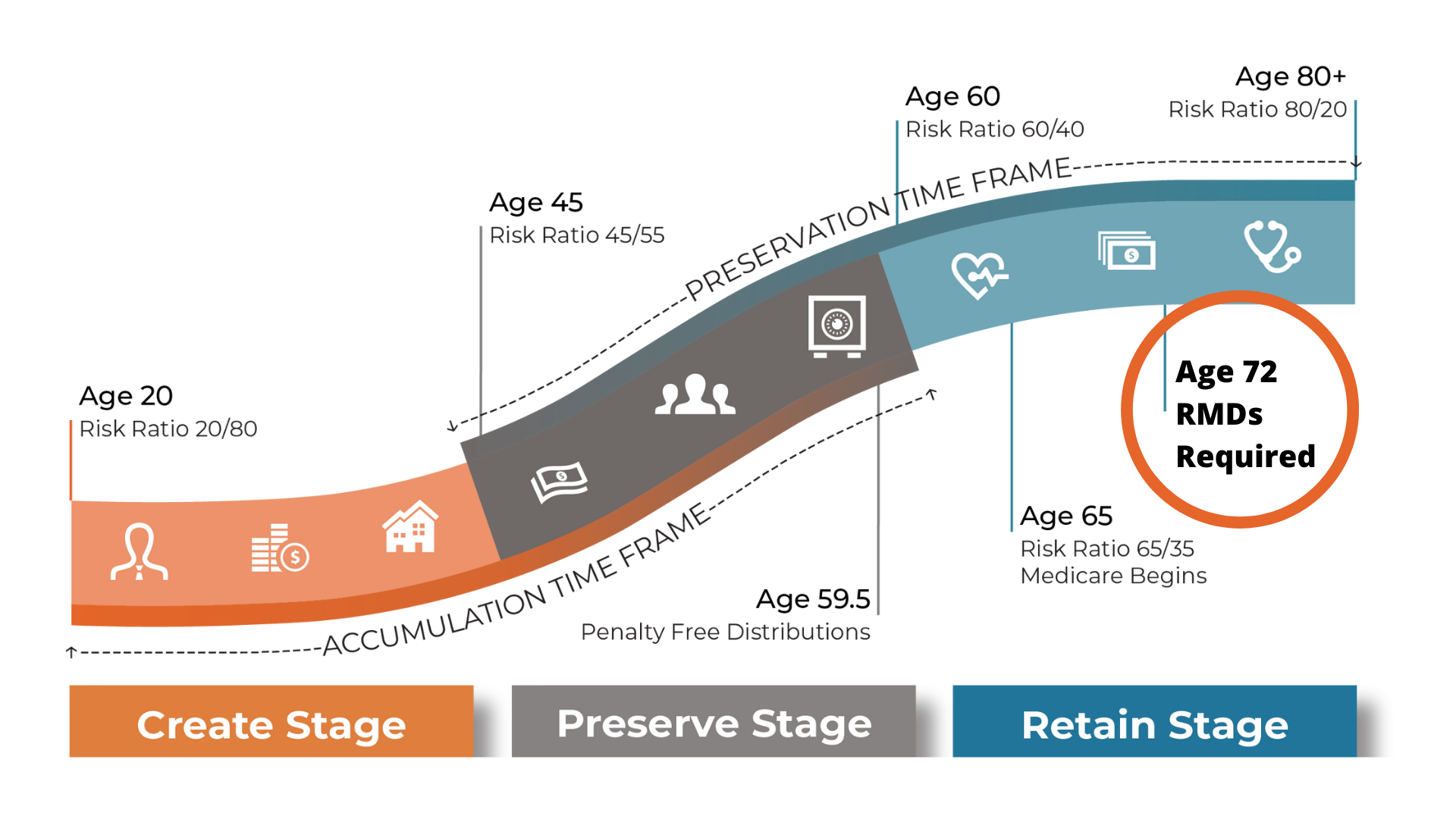

IRAs are categorized as “qualified accounts,” meaning they are not subject to tax until withdrawal. Wealth Management Accounting (WMA) recommends that each client equalize their qualified and non-qualified funds at a ratio close to 50/50. At 72, you incur “required minimum distributions” (RMDs) from your IRA. Suppose your qualified vs. non-qualified funds balance exceeds 50 percent of your investable assets. You could end up with unneeded, increased income due to RMD, placing you in a higher tax bracket and losing retirement dollars to excessive income tax.

Your entire life, you might have heard that an IRA is required to save for retirement, and now it might seem all that preparation went to waste. Not entirely! Instead, consider our IRA Rescue Plan.

Deferring tax with an IRA is an excellent strategy for accumulating wealth early. However, the IRA Rescue Plan minimizes taxation later in life. The process occurs between the ages of 59.5 to 72. It doesn’t mean getting out of the IRA entirely; instead, gradually moving money out of your IRA or 401k and into an after-tax investment as tax-efficiently as possible (to reduce tax liability). The goal is to balance your ratio to the recommended 50/50 ratio or lower, reducing overall taxation later in life. Creating wealth by getting a tax deduction to fund your retirement plan during the working years is beautiful. It’s a blessing to be able to defer the tax while your retirement grows. The goal of the WMA IRA Rescue Plan is to reduce tax liability after you retire!

Some Notes:

Qualified Investments:

- They are commonly known as “retirement accounts” (IRA, 401k, 403b, SIMPLE, SEP, etc.).

- They can be deducted from your taxable income in the year they are made.

- Contributions and earnings from the investment are delayed as taxable income until they are withdrawn (tax-deferred).

- You can delay paying taxes until the year after you turn 72 when RMDs begin.

- Contribution limits apply.

Non-Qualified Investments:

- Accounts that don’t have any tax benefits.

- You can invest as much or as little as you want in any given year.

- You can withdraw funds at any time.

- Growth can be tax deferred.

Benefits of the IRA Rescue Plan:

- Opportunity to transfer more of your wealth to the next generation.

- Control your tax liability.

- Control forced distribution after age 72.

It takes a comprehensive and in-depth plan to:

- Move money tax efficiently from qualified to non-qualified accounts.

- Minimize overall tax liability.

There is no silver bullet! Each situation requires a different and unique plan tailored to meet varying goals and needs. That’s where we can help! We are the experts in designing a plan to re-balance your qualified vs. non-qualified ratio and protect your wealth, which is essential to actual wealth management. Consult a WMA professional to determine your qualified fund’s percentage and the best solution to avoiding the IRA time bomb.

The IRA Rescue is not the only service we offer to ease the transition into retirement. It is only one aspect of our Financial Circle of Care (FCOC). The FCOC provides additional planning tools, such as the Family LLC, enhancing financial planning and tax efficiency strategies. Often overlooked is the need for survivor assistance and nursing home planning. The IRA Rescue Plan is one of WMA’s valuable tools for creating and managing wealth. WMA offers many choices to enhance your financial well-being and future success.