One team. One solution.

A cohesive plan for managing your wealth

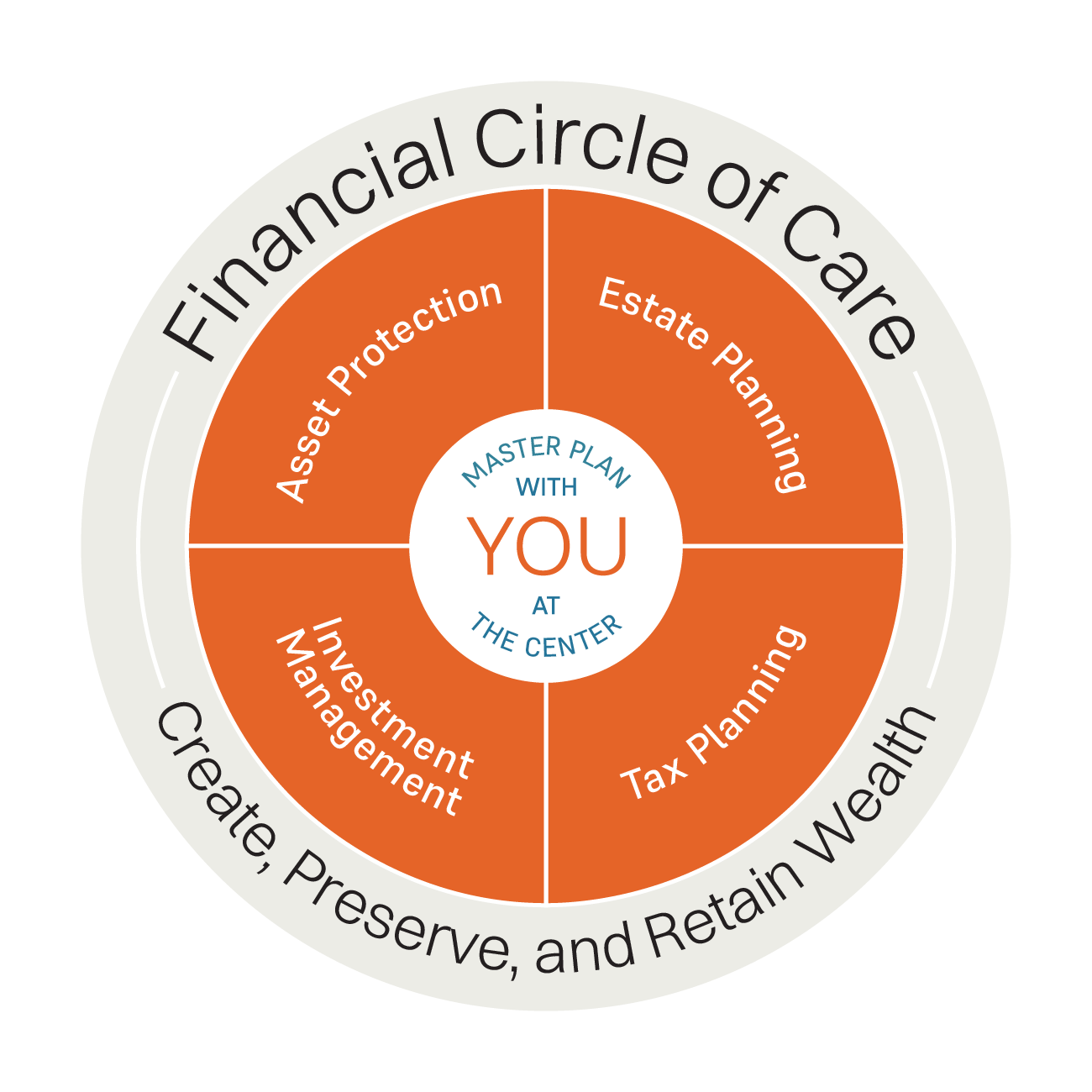

Trying to create and protect wealth often involves consulting with multiple professionals, yet still lacks the cohesion needed to truly maximize your tax savings and optimize your investments. Our All-Inclusive Wealth Management approach provides you with a fully integrated solution combining the four pillars of our Tax Planning, Asset Protection, Estate Planning, and Investment Management strategies to determine the best course of action for your lifestyle.

Tailored to your Wealth Life Cycle

STAGE 1

Create Wealth

Age: 20 – 45

Conservative to Aggressive Investing Ratio: 20/80 – 45/55

OVERALL GOAL:

Accumulate as much wealth as possible

STAGE 2

Preserve Wealth

Age: 45 – 60

Conservative to Aggressive Investing Ratio: 45/55 – 60/40

OVERALL GOAL:

Begin the process of preserving your wealth and preparing for retirement

STAGE 3

Retain Wealth

Age: 60 – 80

Conservative to Aggressive Investing Ratio: 60/40 – 80/20

OVERALL GOAL:

Retain as much wealth as possible

WHAT TO EXPECT

1. A Master Plan

After discussing your lifestyle and goals, with you in the driver’s seat, our team will create and manage a one-page master plan guaranteed to ensure the highest efficiency and greatest accumulation of wealth possible.

Your fully customized plan will include all of the following:

- Investment growth

- Tax Efficiency Planning

- Qualified Money Ratio

- Estate Planning

- Asset Protection

- IRA Rescue (Qualified Fund Reduction)

- Medicaid Spend-down

- Charitable Giving

WHAT TO EXPECT

2. Annual Meetings

Careful planning is essential in all economic climates. Once your goals are clarified and you have a written plan, we’ll check in annually to ensure you remain on track. We’ll review new strategies to help defer, reduce, or more efficiently manage taxes on your investments.

WHAT TO EXPECT

3. Quarterly Reviews

Additional face-to-face meetings may be needed to discuss goal tracking, asset allocation, family and asset protection, tax planning, and whatever topics are top-of-mind and pertinent to you to help ensure your financial affairs are in order.

WHAT TO EXPECT

All our service offerings

Tax planning is a must to ensure we meet your financial goals — particularly if most of your assets are in tax-qualified accounts. The fact is, taxes can have a significant impact on your investment returns at any stage of your investing life.

A properly prepared Wealth Management Accounting plan will segregate assets in such a way as to achieve the maximum asset protection while also allowing you to avoid probate, and lower your income and estate taxes, which is critical to retaining your wealth for the next generation.

A properly prepared Family LLC will segregate assets to achieve the maximum in asset protection, estate planning, tax planning, IRA Rescue, and Medicaid Spend Down. This allows you to avoid probate and lower your income and estate taxes, which is critical to retaining your wealth for the next generation.

We want your money to grow as much as possible with the least possible tax implications. At each stage of life, we will ensure your money is invested in appropriate products with a comfortable risk ratio that makes sense for you.

Anyone with income or property will want to have a plan to ensure their assets are protected and dispersed according to their values. A well-thought-out estate plan will reduce or eliminate the shrinkage of your estate due to federal and state income and estate taxes, debts, unpaid bills, probate, last-illness expenses, and funeral expenses.

The IRA Rescue works in conjunction with your Estate and Asset Protection Plans to help you reduce the funds visible to Medicaid, for Nursing Home Costs, should the need arise. We will advise you on the best method to transfer funds out of your IRA while reducing tax liability and protecting your assets from future Medicaid issues.

To be eligible for Medicaid long-term care (at home or in a nursing home), an applicant must have income and assets valued at less than a certain threshold. We’ll make eligibility possible by strategically reducing income or assets without violating any of the regulations in place.

Did you know it’s possible to give away some of your wealth now and end up with more later? As part of the WMA strategy, we help clients through a process of identifying what amount of income is enough, how much they want to leave to their families, and how much to leave to charity.

We have a process in place to assist you in making financial transitions and decisions as simple as possible, whether you are our client or the family member of a client. We understand your pain and loss, knowing that you will need answers as soon as possible.

If you or your business has any issues with tax collections, we can help. Our representatives have saved clients millions of dollars in taxes. Just as importantly, they take a holistic team-oriented approach that incorporates our advisors, accountants, and your goals to ensure not only the best resolution of the tax issues but also the best overall resolution to meet your overall needs.

Bookkeeping is the bedrock of sound financial planning. By understanding your numbers today, you pave the way for future success. As you grow, WMA’s complete range of services ensures a seamless transition from simple bookkeeping to comprehensive financial planning and wealth management.

Navigate the Retain Stage of your wealth management journey with confidence and clarity. The Financial Circle of Care (FCOC) offers a seamless, all-inclusive approach to safeguarding and optimizing your family’s finances, ensuring peace of mind for both parents and children, all under one fixed fee.

Fixed-fee pricing

Whether you’re an individual or the owner of a small business, you can wave goodbye to fee- and commission-based services. Not only do you have one team at WMA, you will also only ever pay one fixed fee.

1040 Simple Tax Return:

- Schedule A

- Schedule B

- One state

Family LLC

- 1065 tax return preparation

- K-1 forms

- Funding FLLC

- Limited bookkeeping

- Medicaid Spend Down

- IRA Rescue

- Survivor Assistance

- Asset Protection

Additional services*

- Schedule D (Capital Gains & Dividends)

- Schedule E (Rentals)

- Schedule F (Real Estate)

- 1065, 1120, and 1120S return preparation

- Additional bookkeeping

*Additional accounting services are priced separately upon request