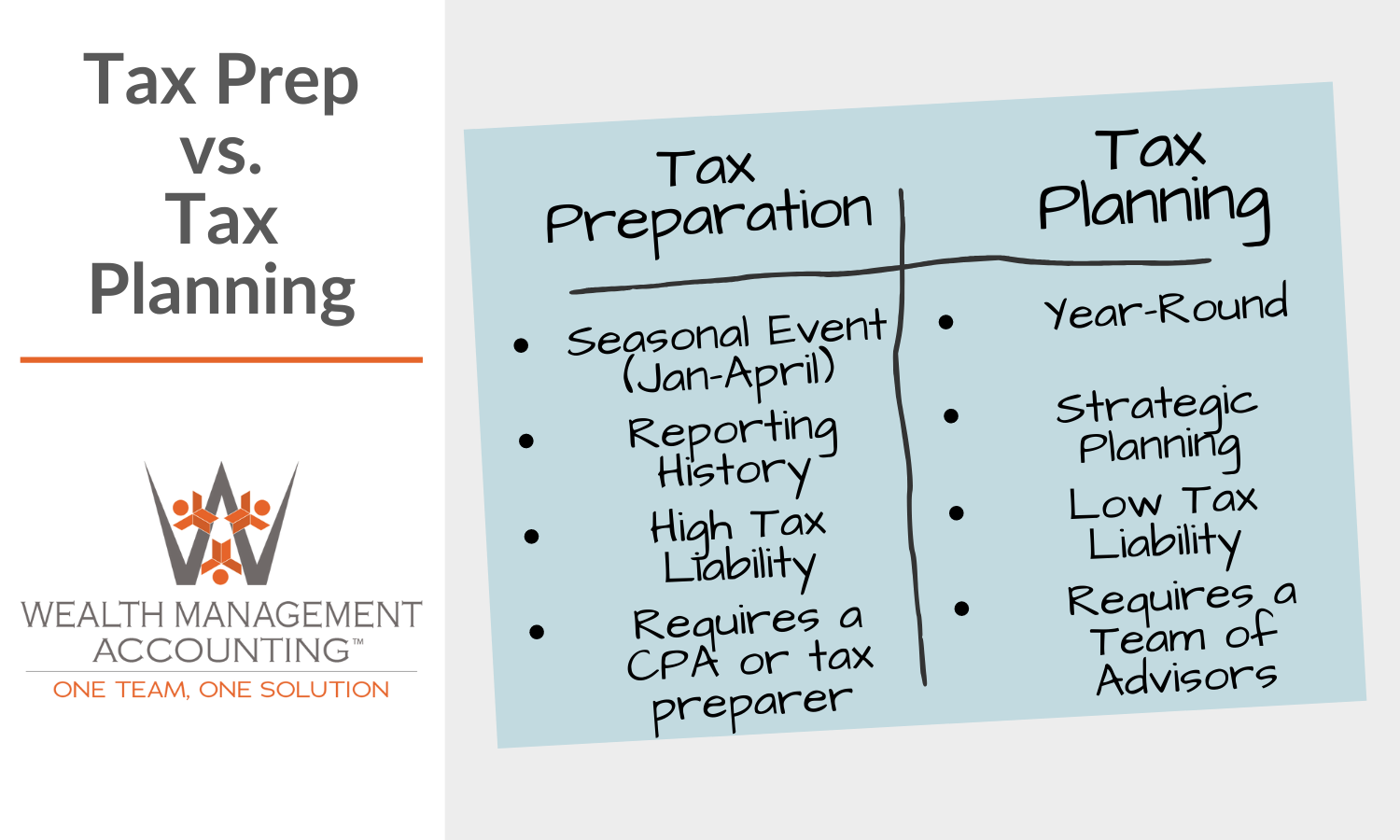

Simply put, Tax Preparation is looking into the past, and Tax Planning is looking to the future.

What is Tax Preparation?

Tax preparation is the process of preparing and filing a tax return. Generally, it is a one-time event that culminates in signing your return and finding out whether you owe the IRS money or will be receiving a refund.

For most people, tax preparation involves one or two trips to your accountant (CPA), generally around tax time (i.e., between January and April), to hand over any financial documents necessary to prepare your return and then to sign your return.

Most tax preparers, CPAs, and Enrolled Agent’s specialize in Tax Compliance, Tax Management, and Tax Preparation. They do not provide: Tax Planning

What is Tax Planning?

Tax Planning is a plan of action for reducing taxes, regardless of your business or investment situation. It is more than just wishing you could pay fewer taxes. It is a plan crafted to ensure you pay the least amount of tax allowable by law. A plan made possible by utilizing several different tax diversity tools.

An effective tax plan optimizes the way your business income and personal spending is structured. It will detail how you can reduce your taxes as part of your overall wealth plan.

Tax planning is different from the typical practices of CPAs. The tax plan you choose is all about the future of your finances and your business.

Why is it important to know the difference between Tax Preparation and Tax Planning?

An effective tax plan can help you shift from seeing taxes as a major expense to seeing taxes as a major asset. The money you save in taxes can be re-invested in your business, real estate, stocks, or anything else you desire. As you develop your tax plan, you will be forced to get a clearer perspective on where you are today and where you want to be in the future. You’ll structure your business entities and investments in a way that best serves your financial goals.

A plan this advanced isn’t possible without a knowledgeable and skilled team of advisors that work together to help you achieve your personal goals and dreams.

DID YOU KNOW?

“You may not realize this, but it’s true: The tax laws are written to reduce your taxes, not to increase them. In the United States, for example, there are over 5,800 pages of tax law. Only about 30 pages are devoted to raising taxes. The remaining 5,770 pages are devoted entirely to reducing your taxes. In other words, 0.5 percent of the tax code is devoted to raising taxes, and the remaining 99.5 percent exists solely for the purpose of saving you money.”

Wheelwright, Tom. “The Two Most Important Rules.” Tax-Free Wealth, 2nd ed., BZK Press, 2018, pp. 18–19.